Although Ethereum rejected the $200 price zone and Bitcoin also rejected the $7,800 price zone, the xbt prime market has been very active over the past 24 hours. Ether, for example, is still trading at $194, just below the weekly high and above the $180-$190 support zone as analysts say.

However, analysts are starting to come to the conclusion that Ethereum will correct itself to the lows, based on a confluence of technical factors as well as signs of a fundamental sell-off.

The sell-off is becoming more and more obvious

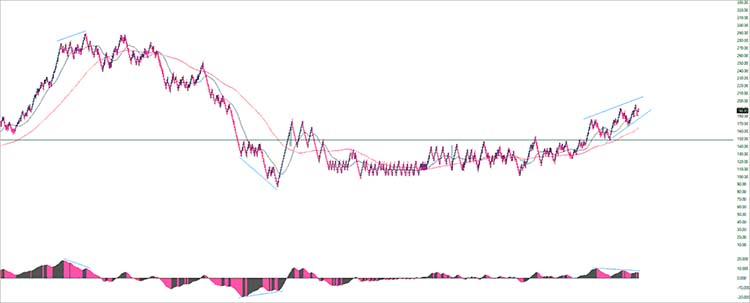

Recently, Josh Olszewicz, analyst at crypto news and data site Brave New Coin, warned that Ethereum price is about to correct. He points out that the elements in the chart below are about to confluence:

- ETH is being traded with a rising wedge pattern. This basic pattern is more likely (60%) to lead to a downtrend.

- A divergence between the trading volume, the RSI and the Ethereum price has just formed, with the first two falling and the last rising.

- ETH is approaching two important levels: a reversal point and a 100% Fibonacci retracement like the March 12 drop.

This shows that Ethereum price is preparing to correct.

Other investors have similar views. For example, Cold Blooded Shiller, an anonymous investor, shared that the chart below shows that the price is about to peak. This chart “shows all major highs and lows” since the start of 2020, marking the year’s $290 high and $90 low on the overcast March 12.

This ETH price chart shows all the major highs and lows. It can be seen that this price area is about to appear a similar pattern. Until then, I will definitely confirm this statement.

You may be interested: H&M targets target customers with Blockchain technology

But the group of whales is preparing for an uptrend

Although technical factors show that the price is trending down, the group of whales or virtual currency magnates are still preparing for a bullish Ethereum market scenario. According to data from Blockchain analytics firm Santiment, the amount of ETH in the wallets holding the most virtual currencies has been on an upward trend in recent months, even continuing to increase after the market crash in March.

The cause of this phenomenon may be the view that is being believed by many people: “the water goes up, the boat goes up” with the event of Bitcoin mining reward halving (Bitcoin Halving). Many analysts believe that this event will be the catalyst for Bitcoin’s price increase.

Not only that, the Ethereum market also shows some positive trends, for example, the daily transaction value on Ethereum is on par with Bitcoin even though the total market capitalization of cryptocurrencies on Ethereum is only 20%. Bitcoin.