From stocks to oil to money printing and Bitcoin’s top fundamentals, traders must consider many things as the third halving nears.

Bitcoin (BTC) has consolidated gains near $8,000 – but will investors let their stocks melt away next week as calculated?

After gaining 10% in just one day last week, the BTC/USD trading pair was successful in keeping its gains at the end of the week. Cointelegraph identifies key factors that traders should keep an eye on to avoid unexpected surprises.

Alarm bells for stocks

Stocks continue to move higher and Bitcoin continues to rise and fall with stock market movements.

Analysts warn that, although the correlation has decreased in recent weeks, Bitcoin remains very sensitive to large swings on Wall Street. This week, prices on Wall Street continue to trend up, but things are not so simple.

Primexbt exchange quoted strategists at Goldman Sachs as saying on April 27, a sharp drop in market coverage in the past often signaled major pullbacks in the market.

A market contraction can last for a very short period of time, but past events signal the emergence of below-average market returns and, ultimately, a reversal of momentum. economic force

There are warnings that profits achieved too quickly at the moment can turn to losses, stemming from concerns about paradox in the market. Despite millions of new jobs, the emergence of small businesses, and trillions of dollars in print, stocks have not stopped rising.

Oil price plummeted when on the exchange

Oil is evaporating first with a prolonged sell-off. In Monday morning trading in Asia, the price of sweet crude (WTI: West Texas Intermediate) fell nearly 10%, while Brent fell 3.2% to nearly $20 a barrel.

The vigilance of a market hit by unprecedented negative prices last week can’t be stopped – consumption hasn’t increased for several months, and storage facilities have run dry.

According to analysts, previous efforts by OPEC+ countries to cut production have not been enough.

Bitcoin is less locally affected by oil problems than other markets.

You may be interested: 3 factors that could cause ETH to correct sharply

The money printer is still working

Central banks continued to pump more worthless cash into the “new feudal” economy and became more and more feudal.

On Monday, the Bank of Japan announced a flood of paper, signaling it was buying unlimited bonds to encourage borrowing.

Questions remain open about whether the US Federal Reserve and the European Central Bank will follow suit, as moves ahead have inflated balance sheets to a record 6.6 trillion dollars.

Bitcoin improves stability fundamentally

For those involved in the Bitcoin network, that reality is increasingly – and likely – taking its toll.

Bitcoin’s hash rate has stabilized since its deep plunge following the March price crash, consolidating its hash rate at around 115 million hashes per second (h/s). According to estimates from Blockchain, this number is only 7 million h/s short of the all-time high at the beginning of last month.

Bitcoin mining difficulty is in place when a steady increase of 3.2% on the next change in about 8 days. This move follows the increase of more than 8.5% previously reported by Cointelegraph.

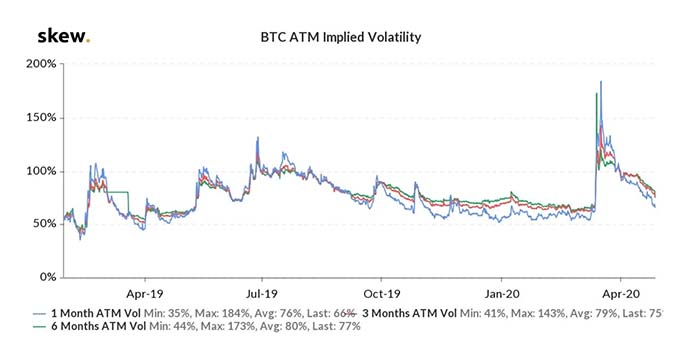

The overall market volatility, as noted by Skew sources, is now almost back on track to early-March levels.

Analysis Dispels Mysteries of May Halving

Just over two weeks left until the third Bitcoin Halving takes place. At that time, the Bitcoin block reward will decrease from 12.5 BTC to 6.25 BTC per block.

This leads to a significant decline in Bitcoin miners’ income, while boosting the stock-to-flow ratio of Bitcoin, because less new Bitcoins will be created relative to the source. existing supply.

Some analysts worry that the drop in revenue will cause problems for Bitcoin miners, but the creator of the model

stock-to-flow has a different mindset:

“The 2012 and 2016 halvings show that mining difficulty will not decrease, but will continue to increase after the halving,” wrote analyst PlanB on Friday.